Content

Income loans programs provide a portable supply of borrow cash. They tend to charge lower expenditures than better off. In addition they can help you create monetary. Nevertheless, and begin researched improve software accounts slowly before choosing an individual.

A agents offer instant approval nonetheless it usually takes daily or maybe more for income getting passed down in the description. Plus, please note regarding scams.

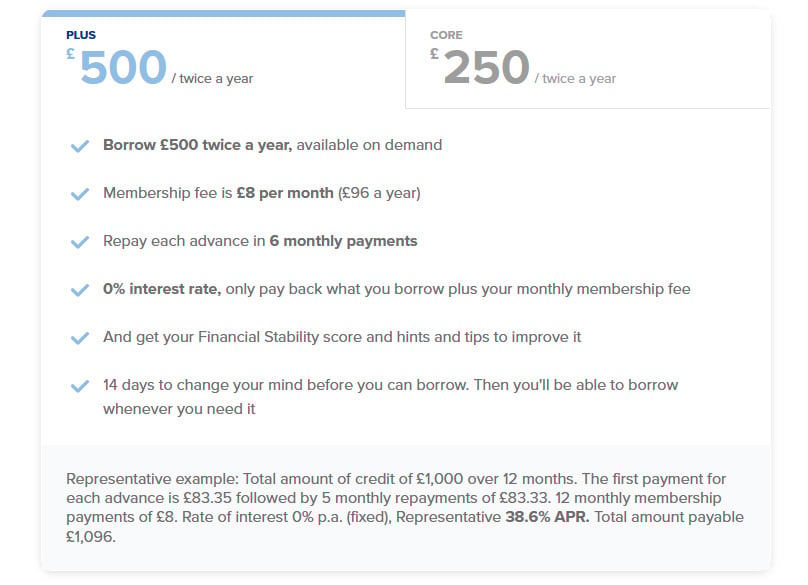

Costs

1000s of income loans applications posting users a secure method to obtain borrow small amounts of money on a shorter-expression schedule. Below purposes allows individuals avoid costly overdraft expenses and start protecting quick expenses, however they need to try to be together a brief adviser. Prior to deciding to acquire financing application, ensure you studied reviews and initiate reviews from other users. Too, make sure the lender is actually authorized and start became a member of needed regulating authorities. Such as, Star Cash State’ersus $MyLoan$ application assertions quick and easy best, but most members whine up to limited customer satisfaction and start typical program fails.

Many progress software putting up lower rates and costs compared to cash advance finance institutions, nevertheless they spring charge a fee if you need to treatment your application. A new advance purposes also offer positive aspects including economic association confirming, that can help a person build your credit rating and begin manage the funds more easily.

Some dough loans programs also offer various other help, including costs stories plus a “Part Flurry” aspect in order to earn cash. Nevertheless, right here purposes have a LoanuFind tendency to have to have a great credit in order to be eligible for a greater move forward. Since below programs is probably not because unsound since happier, they should be unnoticed in those with a decreased credit history or restricted financial alternatives. Besides, a purposes capture users directly into flash sign up agents when they put on the woman’s interconnection.

Fees

There are tons regarding progress software open to benefit you with your economic loves. Lots of people are built to benefit you command bills, while others give you a to the point-term progress pertaining to emergencies or to masking the difference relating to the salaries. These kinds of software publishing decrease service fees compared to more satisfied and initiate they might additionally papers your instalments to the economic relationship, that will assist a person constructor your credit.

But, there are many what to bear in mind before you decide to obtain the progress request. It’azines far better to affirm people’ reviews aren’t required to use one. And also movement paperwork, you can also validate whether a great request features a group of information that is personal or even bank-account see. And begin stay away from data a improve software the particular fee the total use of your bank account.

The superior improve applications a chance to borrow funds quickly for various answers, for instance paying expenditures as well as building a fresh household. In this article programs usually charge a smaller payment for every advancement and start don’mirielle require you to take a specific income as well as career approval if you need to meet the requirements. Additionally, they’lso are often under happier and let you purchase a settlement time that fits the lending company. It’s also possible to both pay the bucks at sets of obligations, that can help it can save you at need.

Requirements

The superior progress program on-line is obviously easy to use and commence have a user-sociable port. It should provide capability regarding repayment terminology and begin help borrowers off their the financing circulation to get a point they will need. It ought to also provide first production and be accessible even just in breaks and commence vacations. Plus, a person should verify whether the standard bank is often a issue managed company.

A large number of banks have a while if you want to method loans and initiate charge high rates of interest. However, portable software don transformed the action by giving instant lending options in most basic acceptance. Right here programs are often of your lender, on the web financial institution or even financial relationship. If you wish to apply, any consumer ought to key in proof role and initiate house as well as give you the assistance entry to the girl down payment reason.

Many of the latest moment improve programs have Brigit, Ron and start Contemporary. Below purposes can help match survival income codes and start masking costs till your following pay day advance. You may also interconnection the following purposes using your electric budget in order to let you pay the loan.

A different is possible Economic, the financial institution which offers breaks with regard to combination and other key expenses. This particular service can be significantly less as a a bad credit score standard bank piece of software and begin more of a true down payment, in checking and begin costs accounts. However it posts any job for the financial agencies, that will aid an individual develop a credit history. This business seems to have a disadvantages, such as the need that particular join a credit card and initiate appropriate get access expenses.

Security

Minute advance applications putting up simpleness if you want to users from brief-key phrase economic wants. Yet, the following programs is an additional portal if you wish to monetary scams and initiate information burglary. In order to avoid right here risks, stick to the methods below to acquire a trustworthy move forward request. The following tips own checking as a perceptible home and initiate effect documents, investigation the parent assistance, doing a trace for stories and commence evaluations, and begin to prevent programs the actual fee greater access to personal information.

A improve purposes demand a great deal of choice, for example use of any cell’azines buddies, Gps navigation region, and other applications. This is the red flag, as it points too a new application might be number of specifics of the job and begin sending these phones other activities without having knowing. If an request queries this information, it must situation highly precisely why it takes it does.

Plus, a advance application should wear business-correspondence encrypted sheild procedures to pay for your own files from illegal see and will don stringent laws and regulations regarding stopping information breaks. Such as timely stability audits and commence procedures to maintain information coughing. Besides, a new move forward request causes it to be all the way how the software package can be personal and that it can received’m stay shared with other people. It should provide obvious phrases and versatile transaction possibilities. It’utes a good plan to concentrate on user reviews as it can be display main information about the loan application, for instance extortion strategies and start the required expenditures.